|

|

|

|

|

|

|

|

Please allow us to present financial highlights.

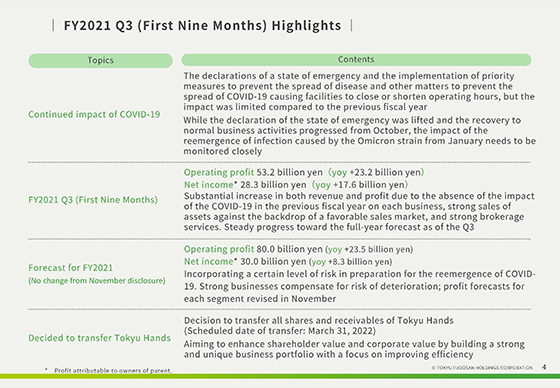

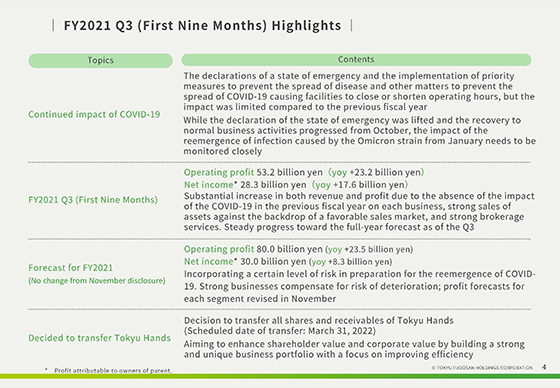

The impact of COVID-19 is persisting, and is particularly affecting the Company’s Commercial Facilities, Wellness and Tokyu Hands businesses. The rescinding of the state of emergency and other restrictions led to progress in the recovery of our business activities to their normal state starting from October. However, the impact on our operations accompanying the reemergence of COVID-19 due to the Omicron variant from January onwards needs to be closely monitored going forward.

In such conditions, for our financial results in the third quarter, operating profit came to 53.2 billion yen and profit attributable to owners of parent came to 28.3 billion yen. Relative to the same quarter in the previous fiscal year, the limited impact of the spreading of COVID-19 coupled with the sales of assets against the backdrop of strong real estate market conditions, the strong performance of real estate sales agents and other factors resulted in an increase in revenues and profit.

For the full year ending March 31, 2022, we are forecasting operating profit of 80.0 billion yen and profit attributable to owners of parent of 30.0 billion yen. At the time we announced our forecast in November, we made change to the breakdown of each segment after taking into consideration business performance trends up to the second quarter and COVID-19 resurgence risk from the third quarter onwards. Our conclusion as of the end of the third quarter is that financial results are progressing steadily relative to our full-year forecast.

Additionally, on December 22, 2021, we made the decision to transfer the Tokyu Hands. This decision is based on our conclusion that given the further acceleration of the shift in the environment of the retail industry, it would be difficult to facilitate the maximization of Tokyu Hands’ value proposition to customers or its business value. Cainz, the transferee in this case, is a top conglomerate that has continued to grow uninterruptedly in the retail industry as well despite its fierce competition. Furthermore, we believe that Cainz as a company shares the values of Tokyu Hands and is capable of melding both companies’ characteristics and strengths. As espoused in its GROUP VISION 2030, going forward, the Group will continue aiming to enhance its shareholder value and corporate value by building a solid and distinctive business portfolio focused on improved efficiency.

|

|

|