|

|

|

|

|

|

|

|

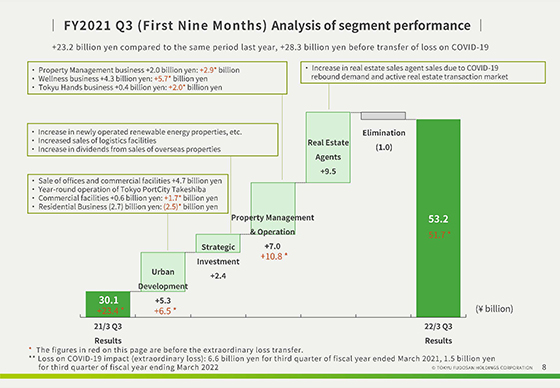

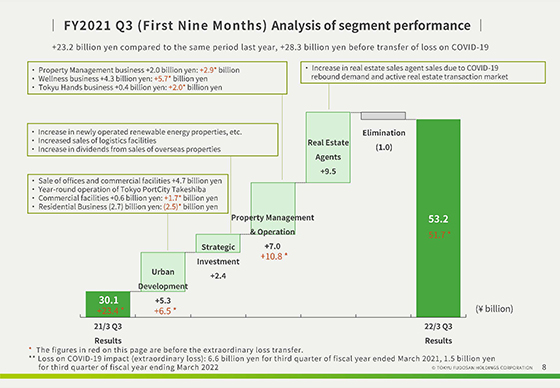

We will provide a per-segment explanation on the factors behind the increases in operating profit in our financial results for the third quarter.

Regarding operating profit for the third quarter and the same quarter in the previous fiscal year and the indications in red under the Urban Development business and Property Management & Operation business segments, values in cases where transfers were not made to loss on COVID-19 impact (extraordinary loss) are indicated.

Overall, operating profit increased by 23.2 billion yen year on year, or by 28.3 billion yen prior to transfer to loss on COVID-19 impact, resulting in an increase in profit for all segments.

For the Real Estate Agents segment, in addition to greater bounce-back from the temporary closure of stores in operation and so forth caused by the impact of COVID-19 in the same quarter in the previous fiscal year, the number of real estate sales agent transactions increased due largely to a brisk real estate transaction market. This and other factors resulted in an increase in profit of 9.5 billion yen.

In the Property Management & Operation business segment, the impact of COVID-19 on the Wellness business and Tokyu Hands businesses is limited compared to the same quarter in the previous fiscal year, and both businesses posted an increase in profit. Overall segment operating profit increased by 7.0 billion yen year on year, or by 10.8 billion yen prior to transfer to loss on COVID-19 impact. We can therefore verify that the segment has recovered from that impact to a certain degree.

In the Urban Development segment, profit increased by 5.3 billion yen year on year, or by 6.5 billion yen year on year prior to transfer to loss on COVID-19 impact, due largely to the sale of offices, commercial facilities and other assets in the brisk transaction market and the full-year operation of TOKYO PORTCITY TAKESHIBA.

In the Strategic Investment business segment, due largely to an increase in new renewable energy facilities in operation and an increase in dividends accompanying the sale of properties under our overseas businesses, profit increased by 2.4 billion yen year on year.

|

|

|