|

|

|

|

|

|

|

|

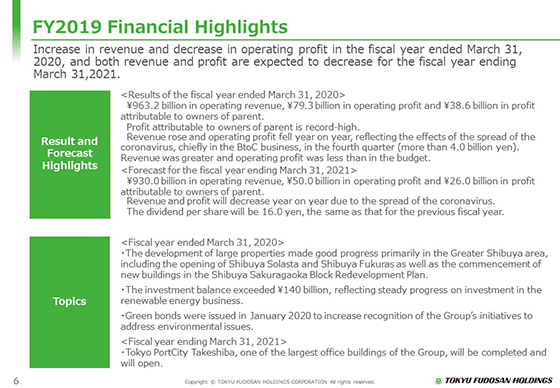

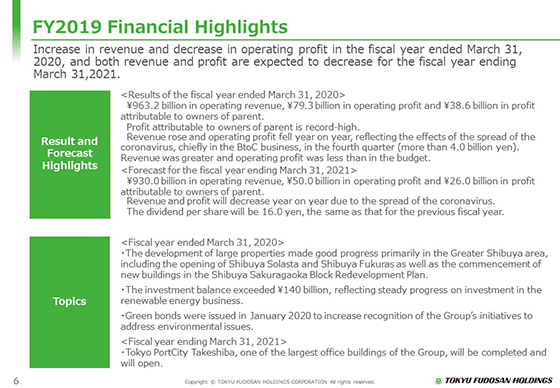

I will now move on to the financial highlights.

Operating revenue in the fiscal year ended March 2020 stood at 963.2 billion yen. Operating profit was 79.3 billion yen.

Although the real estate market was firm, and our results were favorable in the first nine months, revenue rose and operating profit fell in the full year, reflecting the effect of the spread of the coronavirus from the fourth quarter (approximately 4.0 billion yen).

Profit attributable to owners of parent rose for the seventh consecutive year and reached a record high.

The budget for the fiscal year ending March 2021 includes operating revenue of 930 billion yen and operating profit of 50 billion yen.

Due to the spread of the coronavirus, the Group’s business activities will be significantly constrained in the first three months, but will recover gradually from the second quarter.

We expect both revenue and profit to fall year on year.

Although profit is expected to fall, we plan to pay dividends per share of 16.0 yen, the same amount as in the previous fiscal year.

We have three key topics for the fiscal year ended March 2020.

The development of large properties made good progress primarily in the Greater Shibuya area, including the opening of Shibuya Solasta, a new base of the Group, and Shibuya Fukuras, the result of a redevelopment project at a site, including the site of former Tokyu Plaza Shibuya as well as the commencement of new buildings in the Shibuya Sakuragaoka Block Redevelopment Plan.

In the renewable energy business that the Group is focusing on, the operation of large properties started, and investment made good progress. Investments at the end of the fiscal year exceeded 140 billion yen.

We issued our first green bonds, which has financial and non-financial aspects.

This initiative is significant in financing and increasing recognition of the Group’s initiatives to address environmental issues.

Tokyo PortCity Takeshiba, one of the largest office buildings of the Group, will be completed and will open in the fiscal year ending March 2021.

|

|

|