|

|

|

|

|

|

|

|

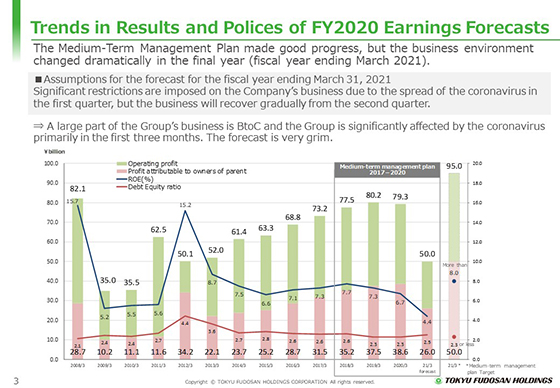

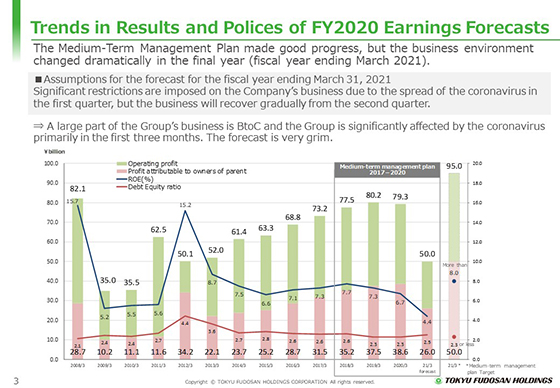

First, let me explain the trends in results and policies in relation to our forecast for the fiscal year ending March 31, 2021.

Refer to page 3 of the handout.

The graph shows trends in results from the global financial crisis.

Subsequently, operating profit plummeted to 35 billion yen, but results grew steadily from October 2013, when the holding company was established. Meanwhile, we strengthened our financial base.

The Medium-Term Management Plan, which started to be executed from the fiscal year ended March 2018, made good progress on the back of a steady business environment. Last May, we revised upward our targets for the fiscal year ending March 2021, the final year of the Plan. We thought that we would more than achieve operating profit, profit attributable to owners of parent, debt-equity ratio, ROE, and EPS targets, among other targets in fiscal 2020.

However, the COVID-19 coronavirus spread from the fourth quarter of the fiscal year ended March 2020, and our business, particularly the BtoC business, was affected significantly. The business environment has changed dramatically.

It was difficult to reasonably estimate the effect of the spread of the coronavirus and forecast the results in the fiscal year ending March 2021. We could have said that the forecast was yet to be determined. However, we assumed that the Group’s business would be restricted significantly in the first quarter and will recover gradually from the second quarter. We have forecasted that operating profit will stand at 50 billion yen and profit attributable to owners of parent will be 26 billion yen.

We have assumed that a wider range of our business will be affected by the coronavirus and have factored in the effects for all segments.

The Group has had a variety of assets and points of contact with diverse customers, when has been one of our strengths. However, a large part of the Group’s business is BtoC and we expect that the Group will face a very challenging business environment, primarily in the first quarter.

|

|

|