|

|

|

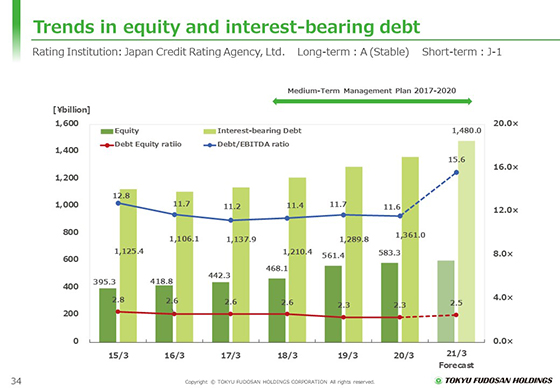

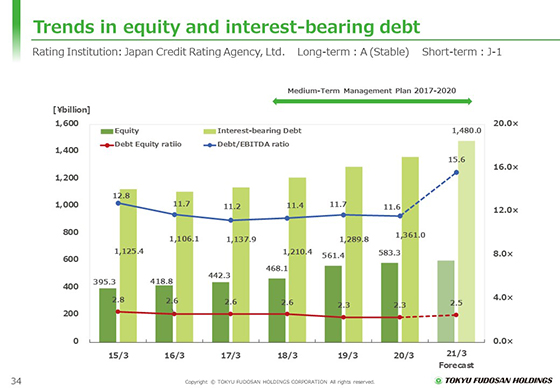

I will now explain the changes in equity and interest-bearing debt.

In the fiscal year ended March 31, 2020, interest-bearing debt increased 71.2 billion yen, to 1,361.0 billion yen, due to new investments and other requirements. The D/E ratio was 2.3 times, remaining flat from the end of the previous fiscal year.

We expect interest-bearing debt to increase by 119.0 billion yen to reach 1,480.0 billion yen in the fiscal year ending March 2021 due to investments in Tokyo PortCity Takeshiba and other large redevelopment projects as well as new and other projects.

We aimed at a D/E ratio of less than 2.3 times at the end of fiscal 2020 in the Medium-Term Management Plan, but the D/E ratio is expected to be 2.5 times.

Our JCR long-term issuer rating has been A since it reached that level in January 2019.

|

|

|