|

|

|

|

|

|

|

|

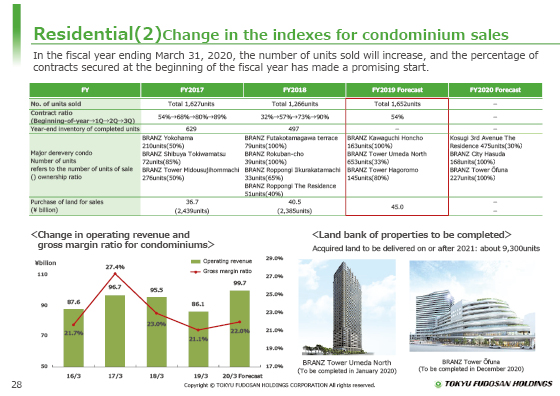

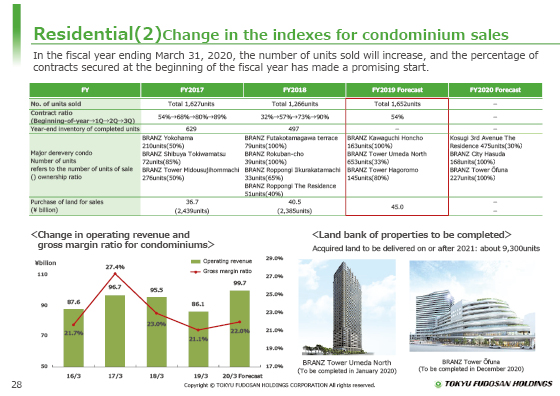

This is showing trends in the performance indicators for condominium sales.

We expect that the segment will sell 1,652 units, up 400 units from the previous fiscal year, for a total of 99.7 billion yen.

The contract ratio to sales forecast for condominiums made steady progress to 54% despite an increase in the number of units available.

The inventory of completed units became 497 by the end of March 2019. The inventory has been gradually decreasing since the end of March 2018, and we will continue the steady sale.

Based on the carefully determined investment policy, we continued to carefully select and purchase land in the fiscal year ended March 2019, which amounted to 40.5 billion yen and was for 2,385 units.

As a result, units for land banking that will be posted from the fiscal year ending March 31, 2021, amount to approximately 9,300.

The gross margin ratio of condominiums for the fiscal year is shown at the lower left.

The gross margin ratio for the fiscal year ended March 31, 2019, was in line with the plan at about 21%. The gross margin ratio for the fiscal year ending March 31, 2020, is estimated to be 22%.

|

|

|