|

|

|

|

|

|

|

|

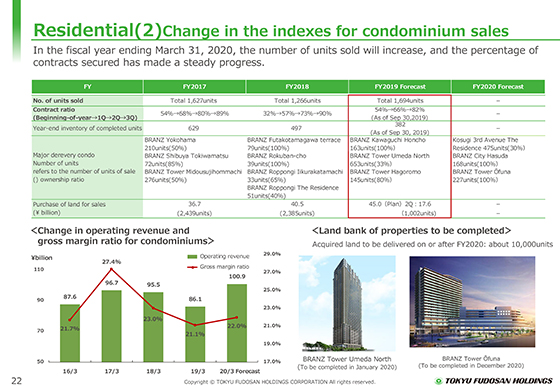

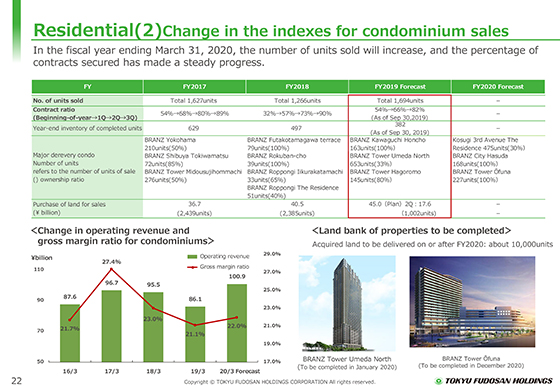

Here are trends in the performance indicators for condominium sales.

In the fiscal year ending March 31, 2020, the segment is expected to record 1,694 units sold, an increase of 428 units, which amount to ¥100.9 billion. The contract ratio to sales forecast for condominiums made steady progress from 54% at the beginning of the fiscal year to 82% as of the end of September.

The inventory of completed units decreased steadily from the level at the end of the previous fiscal year, to 382 units at the end of September.

Regarding the land acquisition, which is shown in the purchase of land for sales of the table, we made a purchase of ¥17.6 billion in the second quarter, which is the land for 1,002 units under the ongoing policy of making selective investments.

The Land Bank, the acquisition of which will be posted in the fiscal year ending March 31, 2021 and beyond, holds approximately 10,000 units.

The gross margin of condominiums for the fiscal year ending March 31, 2020, is estimated to be about 22% as shown in the lower left.

|

|

|