|

|

|

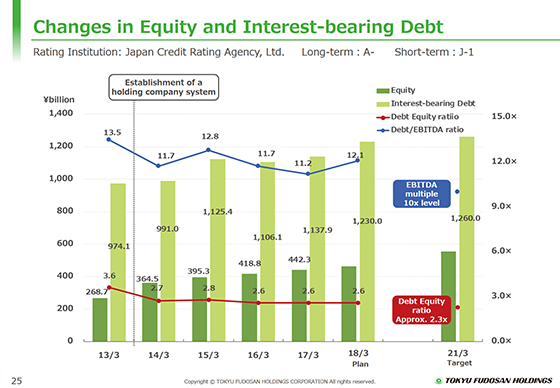

I will explain changes in equity and interest-bearing debt.

We expect to see a steady increase in equity at the end of March 2018 despite a rise in interest-bearing debt attributable mainly to new investments. Accordingly, we forecast that the DE ratio will remain at 2.6 times, unchanged from the end of March 31, 2017, but decline to approximately 2.3 times by the end of March 31, 2021, the final year of the current Medium-Term Management Plan.

The Debt/EBITDA ratio, which has been on the decrease over the past five years, will increase temporarily at the end of March 2018. However, we will reduce it to approximately 10 times by the end of March 31, 2021.

|

|

|