|

|

|

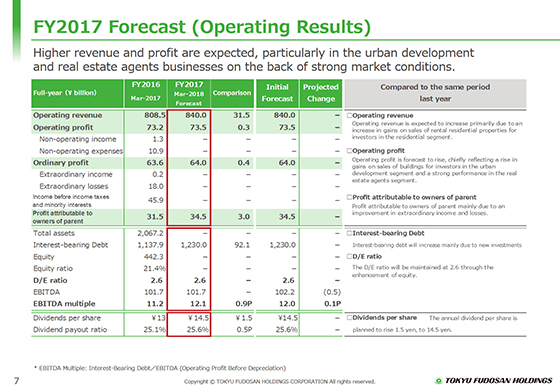

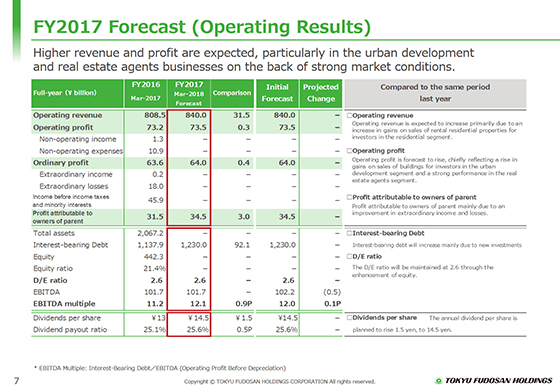

Earnings forecasts for the fiscal year ending March 31, 2018 are explained.

No change is made to the initial forecasts announced in May. The estimated operating revenue, operating profit, ordinary profit and profit attributable to owners of parent are ¥840 billion, ¥73.5 billion, ¥64 billion and ¥34.5 billion, respectively.

The revenue of the Residential segment will increase due to increased revenue from sales of properties including buildings for investors, among others. The profit of the Urban Development segment is expected to increase, mainly due to increased gains on sales of rental housings for investors.

The interest-bearing debts and the debt equity ratio will be ¥1,230 billion and 2.6 times at the end of the fiscal year, respectively, as initially estimated.

In addition, dividends will be ¥14.5 annually per share as initially estimated (interim dividend of ¥7 and year-end dividend of ¥7.5).

|

|

|