|

|

|

|

|

|

|

|

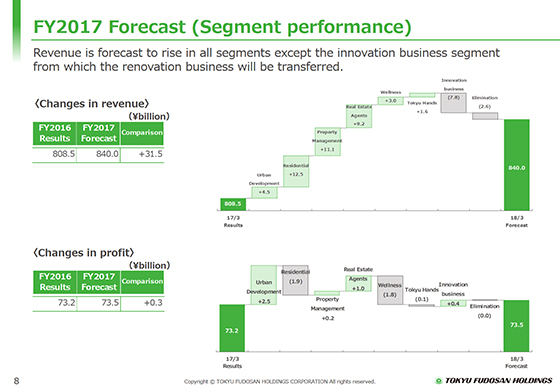

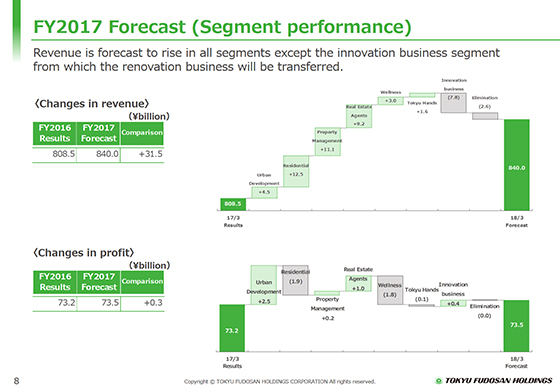

Next, changes in operating revenue and operating profit by segment are explained.

The operating revenue of the Residential segment, as shown in the bar chart in the upper part, will increase due to increased revenues from sales of rental housings for investors and from bulk sales of land, among others.

In addition, in October 2017, the functions of the renovation of condominiums/offices, etc. that the property management and innovation business segments previously performed within the Group are integrated into Tokyu Re· design Corporation, which was newly established in the Property Management segment. Accordingly, the revenue of the Property Management segment will increase and that of the Innovation Business segment will decrease.

Except for the innovation business segment, which is subject to the impact of the transfer of the renovation business, the revenues of all the other segments are expected to increase with the overall revenue increase of ¥31.5 billion year on year.

Overall operating profit shown in the lower part will increase ¥300 million year on year due to increased gains on sales of properties including buildings for investors in the Urban Development segment and increased profit of the Real-Estate Agents segment with good performance that offset the decrease in profit estimated in reaction to the posting of high profits of condominiums in the Residential segment for the previous fiscal period and the posting of sales of land for villas in the Wellness segment, among others.

|

|

|