|

|

|

|

|

|

|

|

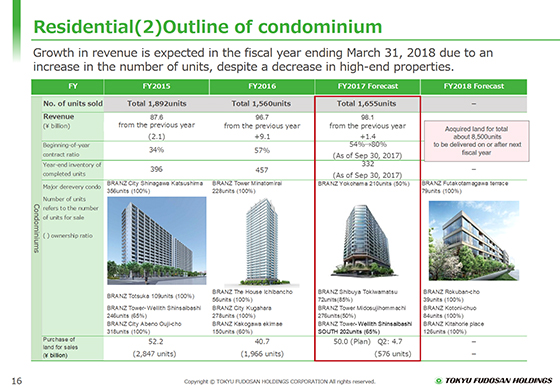

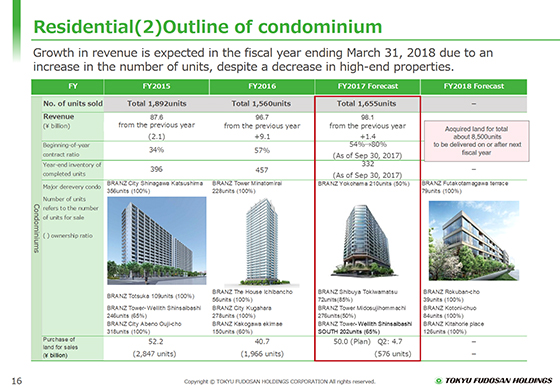

Next is the outline of the estimates of condominiums.

The estimates for the current fiscal period are 1,655 units and ¥98.1 billion.

The ratio of the contract secured to the forecast sales of condominiums, as stated in the middle part of the table, is 80% with smooth progress. The inventory of completed units decreased from the end of March 2017 to 332 units at the end of September.

The gross margin ratio for condominiums is estimated at about 22% for the full fiscal year ending March 31, 2018.

The gross margin ratio for the second quarter was 21.5%.

The status of sales of condominiums seems to be generally strong, while the polarization of selling price continues.

The purchase of land was, as stated in the investment in land below the table, ¥4.7 billion yen and the land for 576 units for the second quarter.

Investments have been made primarily in properties in the metropolitan area, and the redevelopment projects have been carefully selected. As a result, the condominiums to be delivered that will be posted in and after the following fiscal year (ending March 31, 2019) are, as stated on the right-hand side, about 8,500 units.

|

|

|