|

|

|

|

|

|

|

|

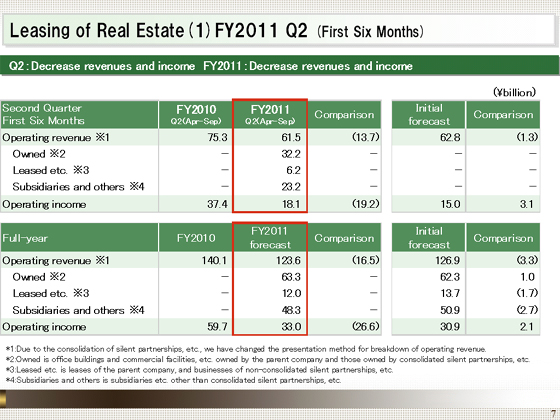

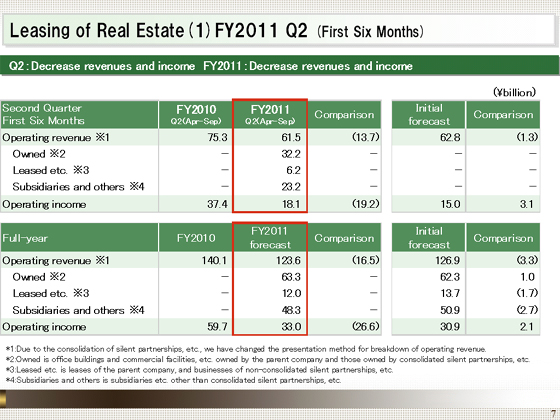

Let me explain the performance of the Leasing of Real Estate segment first.

Operating revenue stood at ¥61.5 billion, down ¥13.7 billion year on year, in the first six months of the fiscal year ending March 2012. Operating income was ¥18.1 billion, declining ¥19.2 billion.

Of the ¥13.7 billion decline in operating revenue, one negative factor was a ¥24.4 billion decline due to the elimination of distributions from the sales of buildings by SPCs that we posted in the first half of the previous fiscal year, partially offset by a ¥4.0 billion increase, mainly reflecting the new operation of a shopping center in Abeno that opened in April and other facilities, along with a ¥6.0 billion increase in revenues due to the consolidation of SPCs in the current fiscal year.

The major factors for the ¥19.2 billion decrease in operating income included ¥24.4 billion attributable to the absence of distributions from the sale of buildings by SPCs that we posted in the first half of the previous fiscal year, as in revenues, offset partially by ¥4.8 billion as a result of posting interest expenses under non-operating income and losses associated with the consolidation of SPCs.

As shown in the lower table, we forecast operating revenue of ¥123.6 billion, declining ¥16.5 billion from the previous year, and operating income of ¥33.0 billion, falling ¥26.6 billion, for the fiscal year ending March 2012.

With respect to factors for the ¥26.6 billion decline in operating income, we anticipate a ¥34.0 billion fall from the previous year due to the lack of distributions from the sale of buildings and a ¥2.2 billion decline attributable to lower rent from existing buildings, among other factors, while we expect operating income to increase ¥8.7 billion due to the consolidation of SPCs, ¥1.5 billion with the operation of new buildings, and ¥1.4 billion due to a fall in loss write-offs. |

|

|