|

|

|

|

|

|

|

|

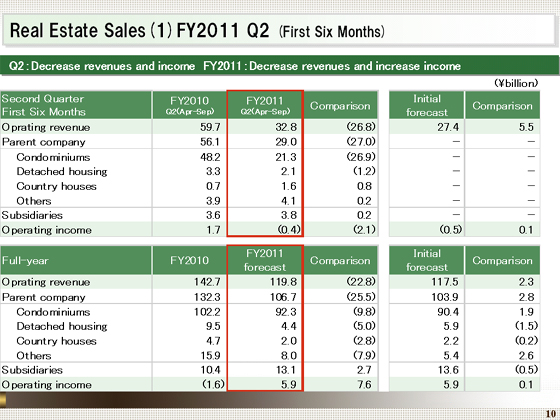

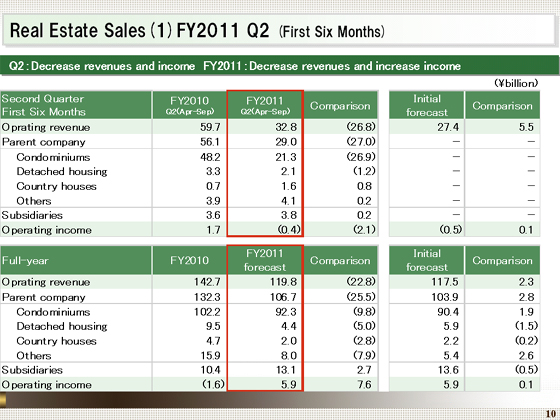

Let me now provide you with a briefing on the Real Estate Sales segment

In the first six months of the fiscal year ending March 2012, operating revenue declined ¥26.8 billion year on year, to ¥32.8 billion, and operating income decreased ¥2.1 billion, to an operating loss of ¥0.4 billion.

Both revenues and income decreased, as the recorded number of condominium units sold declined, reflecting the delivery of large condominiums such as Futako Tamagawa Rise Tower & Residence in the first half of the previous fiscal year.

We also recorded a ¥2.2 billion loss on valuation of inventories centering on land and buildings for business use.

For the fiscal year ending March 2012, we forecast operating revenue of ¥119.8 billion, down ¥22.8 billion year on year, and operating income of ¥5.9 billion, up ¥7.6 billion, as shown in the lower table.

Although we expect that operating revenue will decline, mainly because of a fall in the recorded number of condominium units sold, operating income is expected to increase, given an improvement in the gross margin to around 16% and a significant fall in losses on the valuation of inventories.

|

|

|