|

|

|

|

|

|

|

|

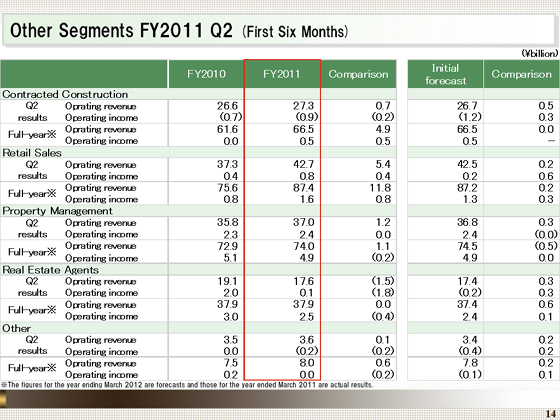

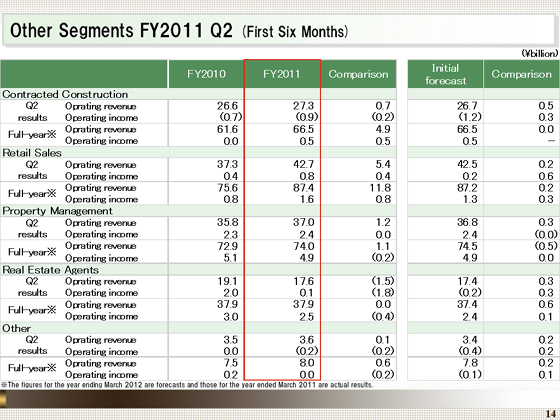

Finally, I will explain the remainder of the segments.

For the Contracted Construction segment, operating revenue rose ¥0.7 billion year on year, to ¥27.3 billion, while the operating loss fell ¥0.2 billion, to ¥0.9 billion.

Revenues were up due to an increase in completions of custom-built houses and renovations, and we anticipate higher revenues and income for the full year, given an increase in the construction of common areas in condominiums, etc. at Tokyu Community Corporation.

Operating revenue in the Retail Sales segment increased ¥5.4 billion year on year, to ¥42.7 billion. Operating income rose ¥0.4 billion, to ¥0.8 billion.

Tokyu Hands Inc. enjoyed strong sales of merchandise centering on emergency supplies and goods for battling the heat, and revenues at 18 existing outlets declined only slightly. Both revenues and income increased, supported by the opening of new stores.

Operating revenue in the Property Management segment rose ¥1.2 billion year on year, to ¥37.0 billion, and operating income increased ¥41 million, to ¥2.4 billion.

Both revenues and income increased, primarily thanks to a rise in the number of units that we managed at Tokyu Community Corporation. We expect that operating income will fall slightly for the fiscal year ending March 2012, given an increase in expenses for improving the quality of services and other products.

For the Real Estate Agents segment, operating revenue decreased ¥1.5 billion year on year, to ¥17.6 billion, and operating income was down ¥1.8 billion, to ¥0.1 billion.

In the consignment sales business, revenues declined due to the absence of sales for large condominiums including Futako Tamagawa Rise that the segment recorded in the first half of the previous fiscal year. In the real-estate sales agents business, although contracted prices rose in the wholesale business as we geared up efforts for large projects, the number of contracts declined in the retail sales business given the cautious stance of purchasers, reflecting the uncertain economic outlook among other factors.

For the full year, we expect that both revenues and income will decline in this segment, given the absence of the contract for large projects which the segment posted in the first half of the previous fiscal year, although we believe that revenues will increase in the real-estate sales agents business.

That concludes my overview of our operating results for the first half and our full-year forecasts for the fiscal year ending March 2012. |

|

|