|

|

|

|

|

|

|

|

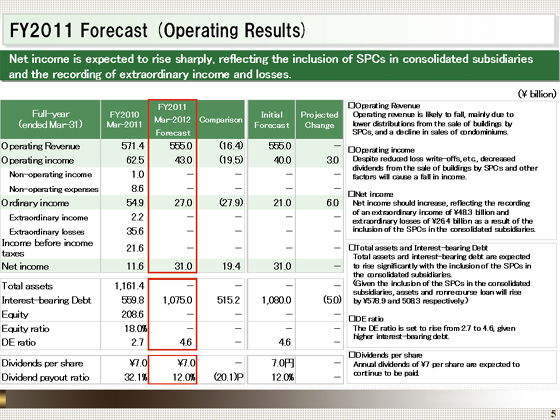

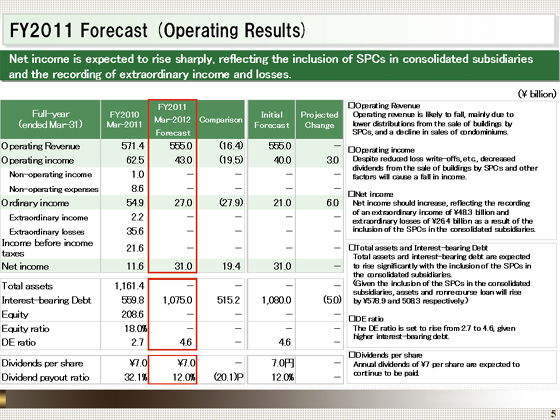

I will now give you a briefing on our forecast for the fiscal year ending March 2012.

We forecast operating revenue of ¥555.0 billion, operating income of ¥43.0 billion, ordinary income of ¥27.0 billion, and net income of ¥31.0 billion.

Although we expect that revenues and income will decrease, given falls in distributions from the sale of buildings by SPCs and the sale of condominiums, etc., as in the first half of the fiscal year, we anticipate a significant increase in net income, given that we posted net extraordinary income and losses of ¥21.9 billion in association with the consolidation of SPCs.

In comparison with our initial forecast, we expect that operating income and ordinary income will increase, primarily reflecting the improving performance of the Leasing of Real Estate segment and a fall in non-operating expenses. Our net income forecast remains unchanged from the initial projection, taking extraordinary income and losses into account, among other factors.

Interest-bearing debt is expected to increase ¥515.2 billion from the end of the previous fiscal year, to ¥1,075.0 billion, given the consolidation of SPCs. As a result, we expect the DE ratio to stand at 4.6.

Annual dividend per share is expected to be ¥7.0, as in the fiscal year ended March 2011. |

|

|