|

|

|

|

|

|

|

|

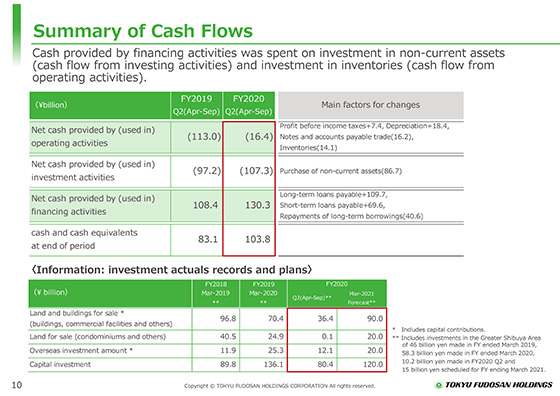

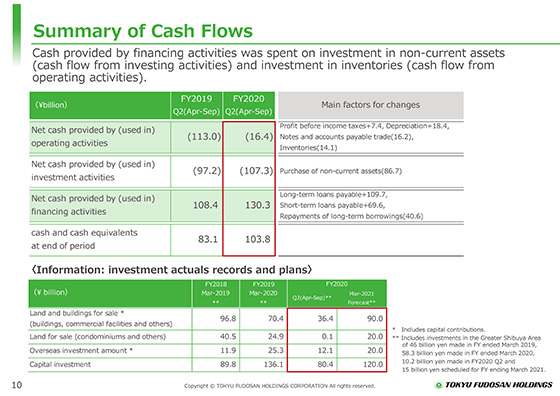

This shows the state of cash flow.

Operating cash flow and investment cash flow decreased 16.4 billion yen and 107.3 billion yen, respectively, mainly resulting from investments in land and buildings for sale and property and equipment and intangible assets in the first six months. With the appropriation of 130.3 billion yen in cash provided by financing activities, including fundraising through interest-bearing debt, cash and cash equivalents at the end of the second quarter was 103.8 billion yen.

The lower table shows investment records and the plan.

In the first six months, we made a 36.4 billion yen investment in renewable energy facilities and logistics facilities regarding land and buildings for sale. The 90.0 billion yen is set in the investment plan for the full year.

Regarding the purchasing of land for condominiums, it resulted in fewer purchases in the first half, but there is no change in the investment plan for the full year from the initial anticipation standing at 20.0 billion yen as a carefully selected investment stance remains in place.

Lastly, regarding capital investment, 80.4 billion yen was invested chiefly in predetermined projects, including Tokyo PortCity Takeshiba, in the first half and 120.0 billion yen is expected in the investment plan for the full year.

|

|

|