|

|

|

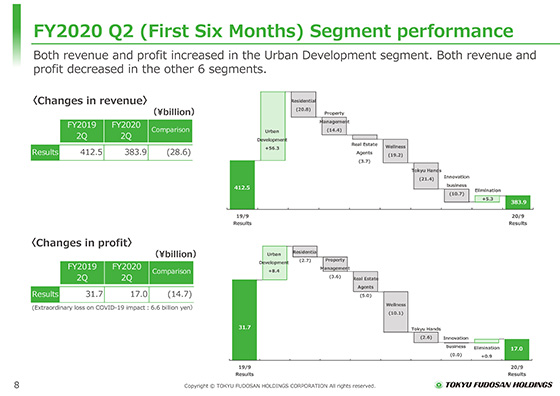

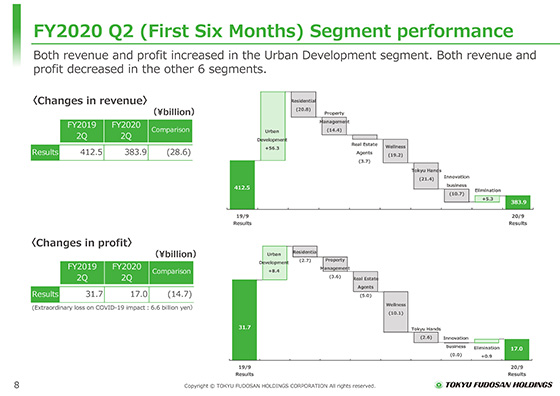

I will now explain the results of operating revenue and operating profit by segment.

The upper graph shows operating revenue and the lower graph shows operating profit, indicating year-on-year declines in both revenue and profit.

In the Urban Development segment, revenue and profit increased due to an increase in gains on the sales of properties including buildings for investors. In the other six segments, revenue and profit decreased due to a strong COVID-19 impact mainly in the Wellness segment and the Tokyu Hands segment.

The Group closed commercial facilities, facilities under management, and stores in response to calls by central and local governments for people to refrain from going out due to the spread of the coronavirus.

Therefore, the Group recorded 6.6 billion yen of fixed costs incurred during the ensuing period of closure, such as rent, depreciation and labor costs, as extraordinary losses.

I will explain the details by segment later.

|

|

|