|

|

|

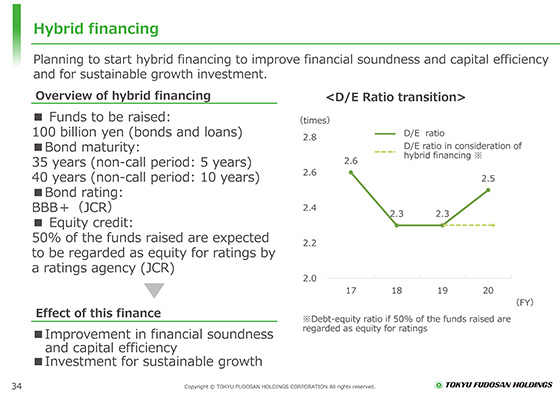

I will tell you about hybrid finance.

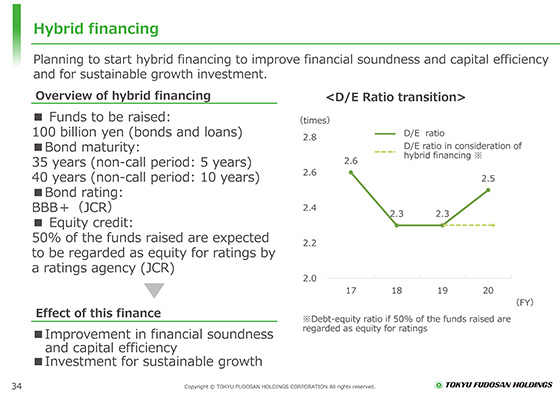

We will execute hybrid finance, aiming for financial soundness, improvements in capital efficiency, and sustainable investment for growth. Combining hybrid corporate bonds with hybrid loans, we plan to raise 100.0 billion yen in total.

For hybrid corporate bonds, 50% of the funds raised are expected to be regarded as equity for ratings by a ratings agency (JCR). The fundraising will enable the achievement of investments for sustainable growth while maintaining disciplined financial management.

Part of the hybrid corporate bonds (term of 40 years (non-call period of 10 years)) are to raise funds in the form of sustainability bonds.

|

|

|