|

|

|

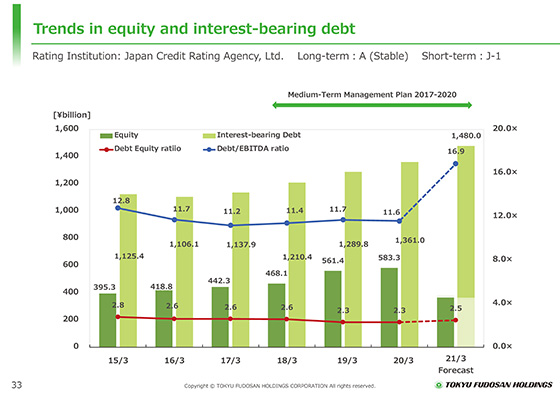

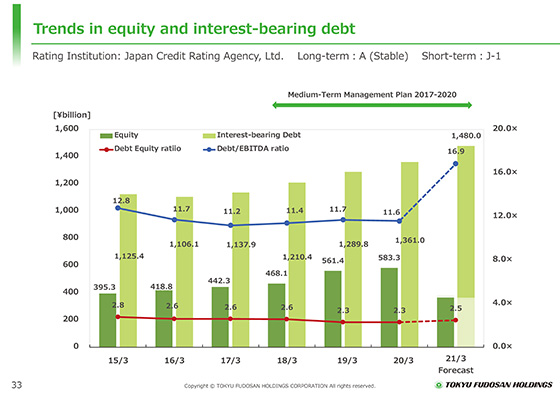

I will explain the trends in equity and interest-bearing debt.

For the fiscal year ending March 31, 2021, interest-bearing debt is expected to increase 119.0 billion yen to 1,480.0 billion yen chiefly due to investments in large-scale redevelopment, including Tokyo PortCity Takeshiba and new investments.

We set a target of D/E ratio to be below 2.3 times at the end of the current fiscal year in the Medium-Term Management Plan, but to be 2.5 times for the full-year forecast.

Even in the current fiscal year amid the COVID-19 pandemic, the long-term issuer rating of A (prospect: stable) given by JCR is maintained.

|

|

|