|

|

|

|

|

|

|

|

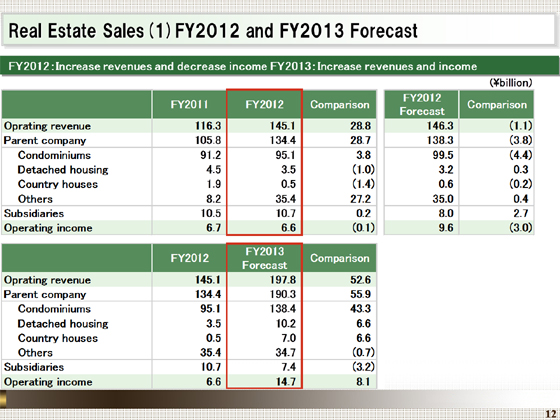

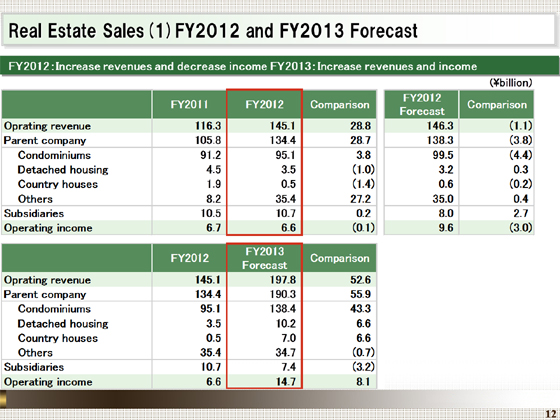

Let me now provide you with a briefing on the Real Estate Sales segment.

In the fiscal year ended March 2013, operating revenue increased ¥28.8 billion from the previous fiscal year, to ¥145.1 billion, and operating income decreased ¥0.1 billion year on year, to an operating income of ¥6.6 billion.

Revenues increased, primarily thanks to the sale of office buildings and commercial facilities owned as inventory to a REIT, while income declined, mainly due to the recording of a loss on valuation of inventory of ¥4.1 billion.

As for condominiums, although the recorded number of condominium units sold declined, the per-unit price increased. As a result, revenues increased and the gross margin also recovered to 21%.

With respect to the forecast for the fiscal year ending March 31, 2014, in the lower column, we expect operating revenue of ¥197.8 billion, up ¥52.6 billion from the previous fiscal year, and operating income of ¥14.7 billion, up ¥8.1 billion year on year.

We plan higher revenues and income, mainly reflecting a decline in a loss on valuation of inventory, in addition to an increase in revenues of condominiums and other factors.

|

|

|