|

|

|

|

|

|

|

|

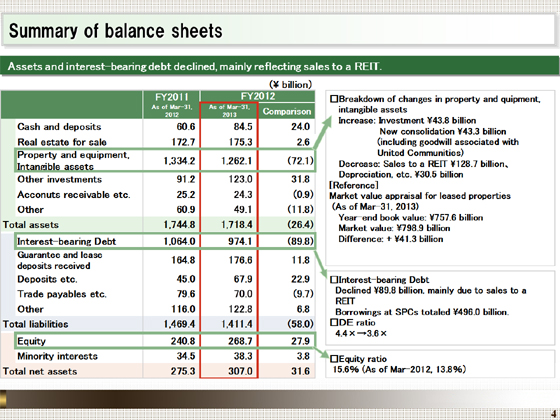

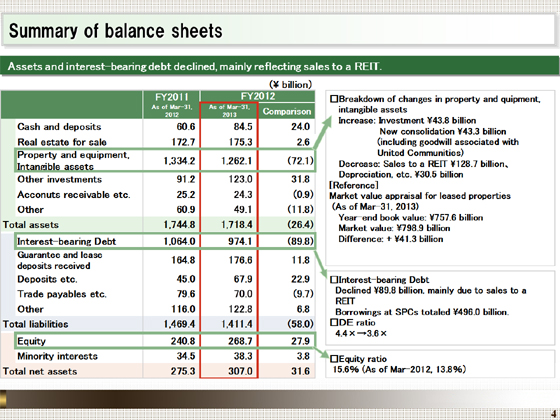

Next I will provide an overview of the balance sheet at the end of the fiscal year.

Total assets at the end of March 2013 fell ¥26.4 billion from the end of the previous fiscal year, to ¥1,718.4 billion. This decline mainly reflected the transfer of assets to a REIT, offsetting factors such as increases in goodwill following the action in which Tokyu Community Corporation acquired United Communities Co., Ltd., a condominium management company, and made United Communities its consolidated subsidiary in February 2013.

Total liabilities decreased ¥58 billion from the end of the previous fiscal year, mainly because of a fall in interest-bearing debt chiefly associated with the transfer of the assets to a REIT.

Interest-bearing debt decreased ¥89.8 billion from the end of the previous fiscal year, to ¥974.1 billion, and the DE ratio also fell from 4.4 at the end of March 2012, to 3.6 at the end of March 2013, partly reflecting an increase in equity among other factors. The equity ratio also rose to 15.6% (an improvement of 1.8 points from 13.8% at the end of the previous fiscal year).

|

|

|