|

|

|

|

|

|

|

|

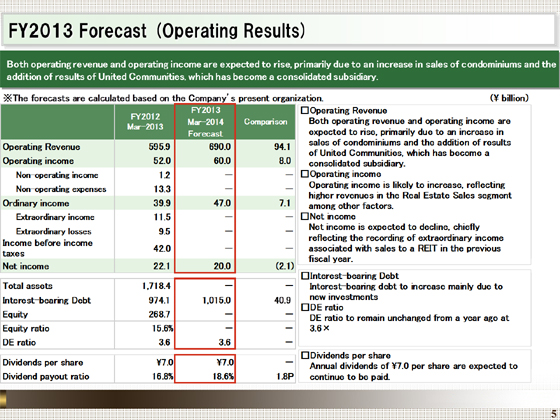

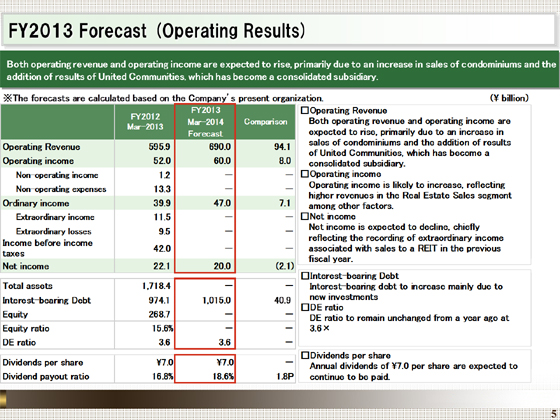

I will now give you a briefing on our full-year forecast for the fiscal year ending March 31, 2014. As announced on May 10, 2013, the Company will change its management structure to a holding company structure through a joint share transfer with Tokyu Community Corporation and Tokyu Livable, Inc. on October 1, 2013.

Please note that the operating and dividend forecasts that we are presenting have been assessed based on the Company's present organizations. We plan to announce the operating and dividend forecasts of the holding company at a later date.

We expect operating revenue to be ¥690 billion, operating income to be ¥60 billion, ordinary income to be ¥47 billion, and net income to be ¥20 billion.

We expect an increase in both revenues and income in the Real Estate Sales segment, reflecting higher sales of condominiums, and in the Property Management segment, given the contribution to revenues from United Communities, which recently became a consolidated subsidiary.

Net income is expected to fall, mainly reflecting the fact that the extraordinary income from sales to a REIT and other factors was recorded in the previous fiscal year.

We anticipate that interest-bearing debt at the end of March 2014 will rise ¥40.9 billion from the end of March 2013, to ¥1,015 billion. Meanwhile, the DE ratio is expected to be 3.6, unchanged, reflecting an increase in equity.

|

|

|