|

|

|

|

|

|

|

|

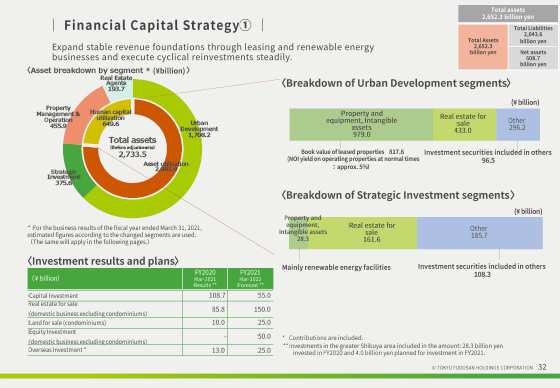

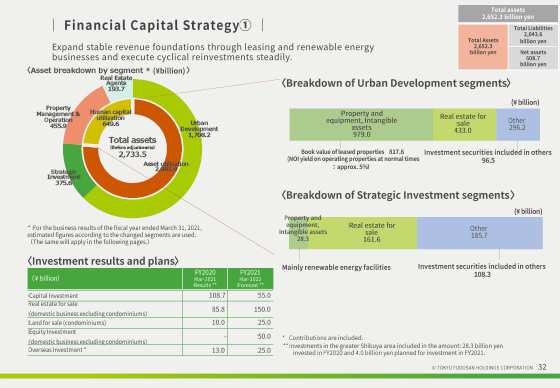

This is an explanation of financial capital strategy.

First, let's look at the left side of the balance sheet, assets. The pie chart on the upper left shows the assets as of the end of March 2021, broken down by new segments.

The 2 asset-utilizing segments account for 76% of the total, with JPY1,708.2 billion in the urban development business segment and JPY375.6 billion in the strategic investment business segment.

Further to the right is a breakdown of total segment assets for the urban development business segment and the strategic investment business segment.

The urban development business segment includes rental offices and commercial facilities in non-current assets, and investment securities in others. Of the non-current assets, other than rentals and real estate, the total is JPY817.6 billion, and the NOI yield at cruising will be about 5%.

The urban development business segment includes leased offices and commercial facilities in non-current assets, and investment securities in others. Of the non-current assets, other than leased properties and real estate, the total is JPY817.6 billion, and the NOI yield at cruising will be about 5%.

The strategic investment business segment includes renewable energy facilities, et cetera, in non-current assets and investment securities, et cetera, in others.

The bottom left shows the actual and planned investments.

The plan for March 2022 is for a decrease in investment in non-current assets as we do not plan to complete construction of large properties, but an increase in investment in inventories to promote cyclical reinvestment.

For the 2 asset-utilizing segments, we will steadily promote investment in non-current assets, which are the foundation for stable earnings, and cyclical reinvestment, aiming to improve the turnover ratio and profit ratio as stated in our long-term vision.

|

|

|