|

|

|

The bottom right corner of the balance sheet shows net assets.

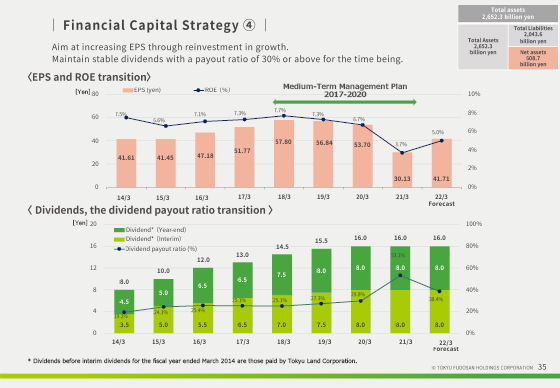

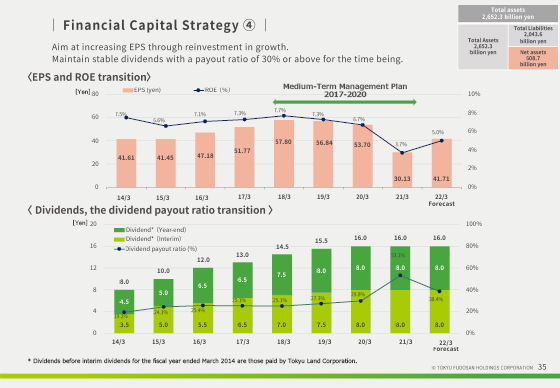

Since the review of the previous medium-term management plan in May 2019, we have been aiming to improve EPS growth and ROE as KPIs in order to enhance shareholder value and corporate value.

In FY2020 ending March 31, 2021, ROE declined due to the impact of COVID-19, but we will aim to achieve ROE of 8% by the mid-2020s. For FY2021 ending March 31, 2022, we plan to achieve a ROE of 5%.

In addition, our long-term vision calls for a dividend payout ratio of 30% or more as our immediate policy for returning profits to shareholders, and we will strive to maintain stable dividends.

The dividend for FY2021 ending March 31, 2022 will be JPY16, unchanged from the previous fiscal year. The dividend payout ratio is planned to be 38.4%.

|

|

|