|

|

|

|

|

|

|

|

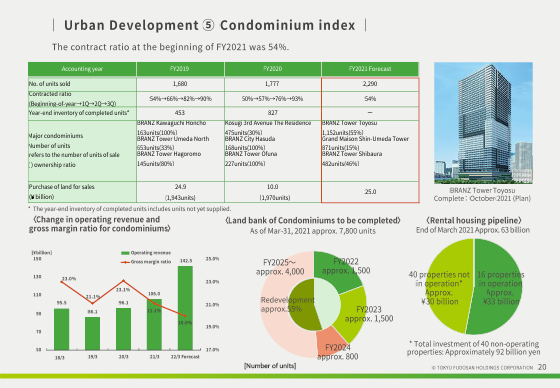

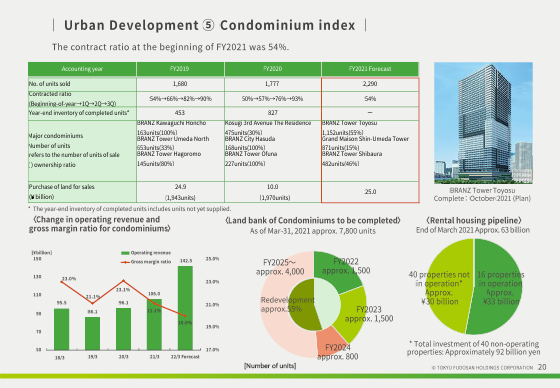

This is a trend of operating indicators for condominiums for sale.

For FY2021 ending March 31, 2022, we plan to record 2,290 units and sales of JPY142.5 billion.

The condominium market has already recovered to the level it was at before the COVID-19 outbreak, and the ratio of contracts secured to sales for FY2021 ending March 31, 2022 was 54% at the beginning of the fiscal year, a higher level than the previous fiscal year.

The gross margin for condominiums for sale is planned to be 20% for FY2021 ending March 2022. As of the end of March 2021, we had 827 units in completed inventory.

The completion of a large property at the end of March 2021 and a change in the condominium sales plan in the previous fiscal year due to the impact of COVID-19 have resulted in a higher level of sales than in the past, but the market is firm, and we plan to continue to steadily promote sales.

With regard to the purchase of land, we acquired JPY10 billion worth of land in FY2020 ended March 31, 2021, equivalent to 1,970 units, mainly in redevelopment properties, based on a carefully selected investment policy.

The number of landmarked properties scheduled to be booked in the FY2022 ending March 31, 2023 and thereafter is approximately 7,800 units, and the percentage of redeveloped properties in landmarked properties is approximately 55%.

We will continue to focus our efforts on redevelopment of high value-added properties.

|

|

|