|

|

|

|

|

|

|

|

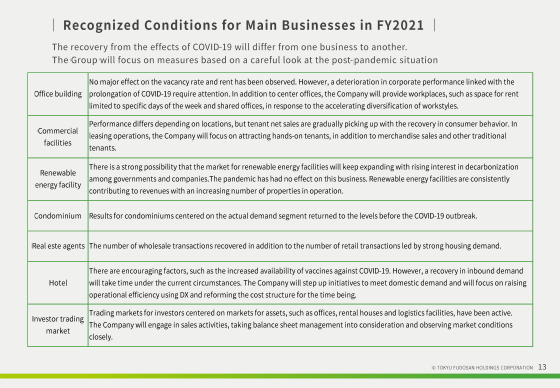

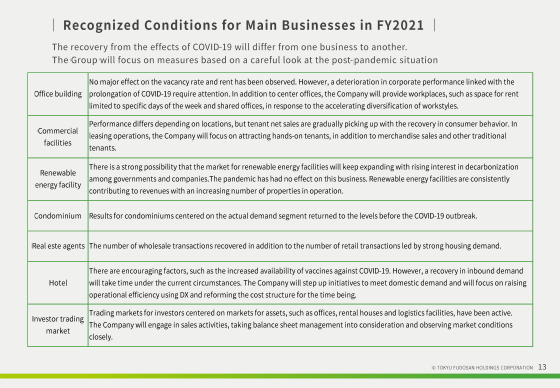

I would like to explain our recognition of the business environment for the Group's main businesses in FY2021, ending March 31, 2022.

In the Group’s office building portfolio, no major effect on the vacancy rate and rent has been observed, despite a fall office demand which became a matter of concern last year. Corporate performance trends require attention, however.

I believe the Group must offer a greater variety of workplaces in addition to center offices in response to the accelerating diversification of workstyles.

Results for commercial facilities have seen repeated rises and falls in the short term due to factors, including the spread of COVID-19. However, net sales for the facilities on the whole are on the road to recovery.

The ideal image for commercial facilities is likely to change as a result of the ongoing pandemic. Given this circumstance, the Group is focusing on attracting hands-on tenants who provide experience-based services, in addition to traditional retail tenants.

Results for condominium and real estate sales agent businesses recovered to their levels before the outbreak of COVID-19 with actual demand as a key factor.

The experience of working from home and similar new practices under the pandemic has been a factor behind residential reexamination. I believe this trend has been one of the drivers of a recovery in market conditions.

Let me explain the environment for the hotel business next.

Members-only hotels in the Tokyu Harvest Club chain are recovering quickly. However, Tokyu Stay budget hotels continue to face difficult conditions.

There are encouraging factors, such as the increasing availability of vaccines against COVID-19. However, a recovery in inbound demand will take time. In light of this situation, the Group will remain focused on better meeting domestic demand, enhancing operational efficiency and reforming the cost structure.

Lastly, let me explain the environment for trading markets for investors.

Market dynamism varies depending on assets, but the trading markets have remain lively with active demand among buyers and low interest rates in the background.

Changes in market conditions require careful attention. Under such conditions, the Group will advance sales activities, taking balance sheet management into consideration.

|

|

|