|

|

|

|

|

|

|

|

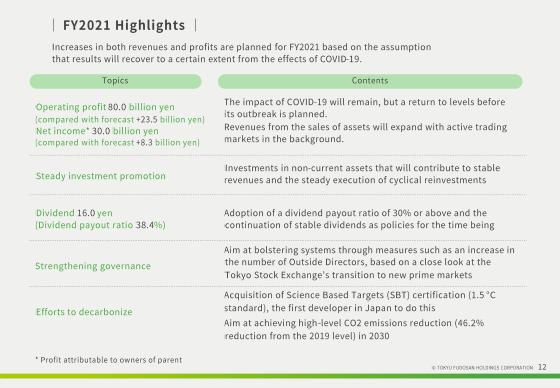

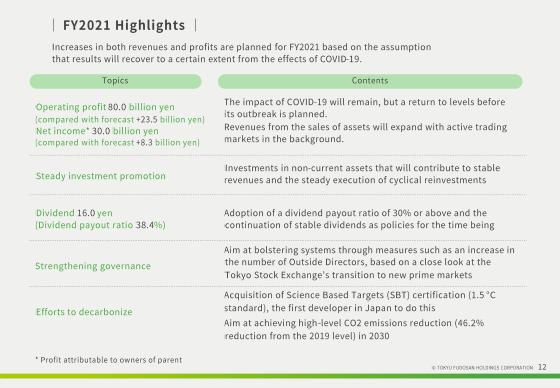

Next, I will explain the highlights for the fiscal year ending March 31, 2022.

First, I will talk about the earnings forecast. The situation regarding COVID-19 continues to be uncertain, as the state of emergency declaration has been extended even recently. Although it is difficult to estimate the impact of COVID-19 on our business forecasts, we have calculated our forecasts for some of our businesses based on certain assumptions.

We aim to achieve a V-shaped recovery in operating profit to the level before the outbreak of COVID-19.

With regard to investments, we will aim to steadily implement cyclical reinvestment by investing in non-current assets that contribute to stable earnings, such as the leasing business and the renewable energy business and investing in land and buildings for sale.

Regarding shareholder returns, we plan to pay a dividend of JPY16 for the fiscal year ending March 31, 2022, unchanged from the previous fiscal year, with a payout ratio of 38.4%.

This is about strengthening governance. In anticipation of the transition to the Prime Market under the new market classification of the Tokyo Stock Exchange scheduled to begin in FY2022 ending March 31, 2023, we will further strengthen our system. Following the general meeting of shareholders in June, we plan to increase the number of outside directors by 2, bringing the ratio of outside directors to 40%.

Lastly, it is about the decarbonization which we are working on. In addition to RE100 and other initiatives, in May we will be the first Japanese developer to obtain SBT certification at the 1.5 degrees Celsius level, aiming to reduce CO2 emissions by 46.2% by FY2030, compared to FY2019.

|

|

|