|

|

|

|

|

|

|

|

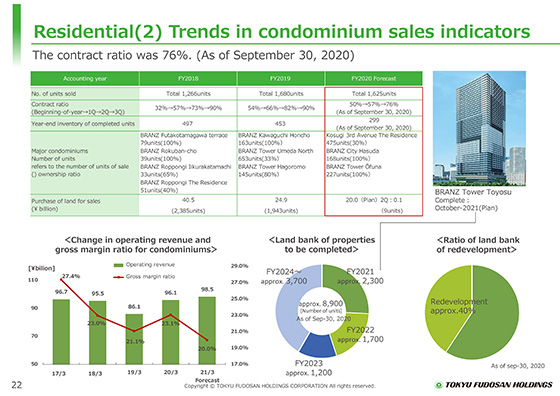

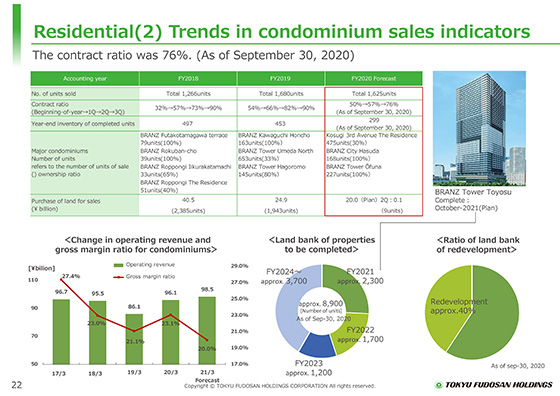

This shows trends in the performance indicators for condominium sales.

We expect that the segment will sell 1,625 units in the fiscal year ending March 31, 2021, a slight decrease from the previous year. Sales are expected to be 98.5 billion yen.

Despite the closure of condominium showrooms and other severe restrictions on sales activities following the declaration of a state of emergency mainly in the first quarter, almost normal sales activities are returning, while limiting visits to condominium showrooms and starting online customer service.

The contract ratio to the sales forecast for condominiums stood at 76% at the end of September, marking steady progress.

The inventory of completed units was 299 at the end of September 2020, and we will continue to steadily sell completed units.

As shown in the lower left graph, the gross margin ratio of condominiums for the fiscal year ending March 31, 2021 is expected to be 20%.

The gross margin ratio for the second quarter was 19%.

We plan to continue purchasing plots based on our policy of investing in carefully selected plots.

Units for land banking that will be posted from the fiscal year ending March 31, 2022 amount to approximately 8,900, and the ratio of land bank redevelopment stood at approximately 40%.

We will continue to focus on high value-added redevelopment properties.

|

|

|