|

|

|

|

|

|

|

|

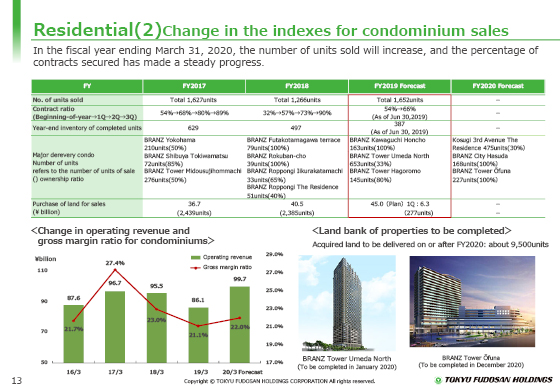

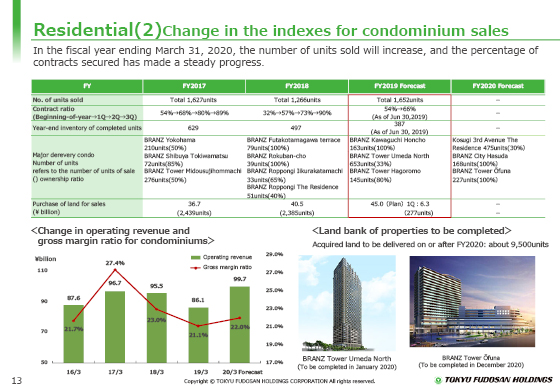

Here are trends in the performance indicators for condominium sales.

In the fiscal year ending March 31, 2020, the segment is expected to record 1,652 units sold, an increase of around 400 units, which amount to 99.7 billion yen.

The contract ratio to sales forecast for condominiums made steady progress from 54% at the beginning of the period to 66% as of the end of June.

The inventory of completed units decreased from 497 units at the end of March 2019, to 387 units at the end of June. We will continue our steady sales efforts.

Under the ongoing policy of making selective investments, the land acquisition was 6.3 billion yen in the first quarter, which is the land for 277 units.

The Land Bank, the acquisition of which will be posted in the fiscal year ending March 31, 2021 and beyond, holds approximately 9,500 units.

The gross margin of condominiums for the fiscal year ending March 31, 2020 is estimated to be about 22% as shown in the lower left.

The gross margin was 19% in the first quarter due to the posting of the inventory of completed units.

We believe the sales of condominiums remain generally stable.

|

|

|