|

|

|

|

|

|

|

|

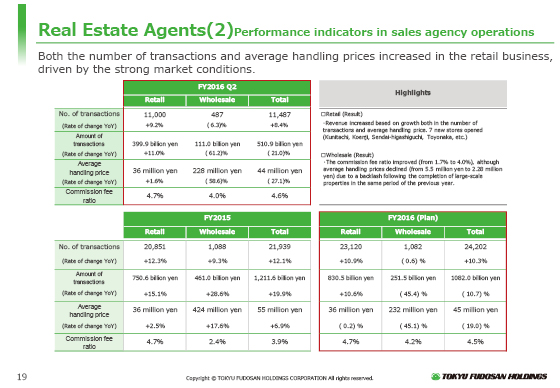

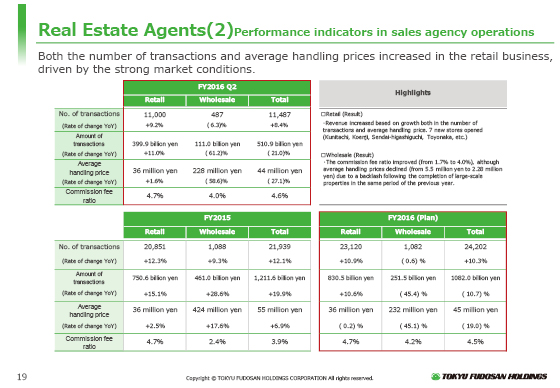

I would now like to explain the performance indicators in the Real-Estate Agents business.

In the first six months of the fiscal year ending March 2017, revenue increased because the number of transactions rose and the amount of transactions increased approximately 10% year on year in the retail division.

We launched seven new stores, thereby expanding our business steadily.

We plan to launch another seven in the second half, which means we will end up opening a total of 14 new stores in the fiscal year ending March 2017.

In the wholesale division, the average handling price declined from ¥550 million a year earlier to ¥228 million due to the contracts for large property units recorded for the same period of the previous fiscal year. However, the commission fee ratio improved from 1.7% to 4.0%.

As presented in the plan for the fiscal year ending March 2017, shown in the table on the bottom right, we expect that the amount of transactions will fall, since the average handling price will decline due in part to the contracts for large property units that were recorded in the fiscal year ended March 2016.

|

|

|