|

|

|

|

|

|

|

|

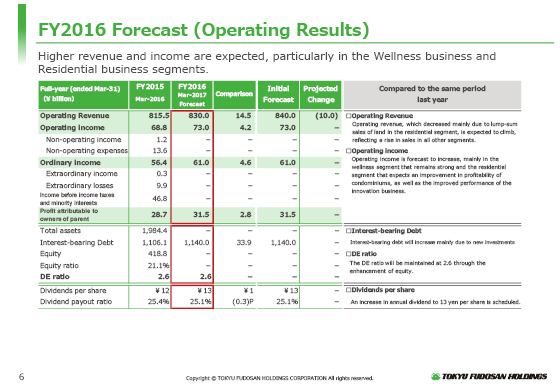

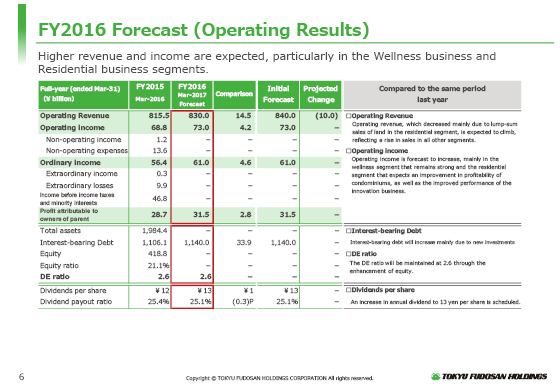

I will now provide you with a briefing on our full-year forecast for the fiscal year ending March 31, 2017.

We expect operating revenue to be ¥830 billion, operating income to be ¥73 billion, ordinary income to be ¥61 billion, and profit attributable to owners of parent to be ¥31.5 billion for the fiscal year ending March 31, 2017.

While revenue in the Residential segment is expected to fall, due in part to a decrease in lump-sum sales of land, we expect higher revenue because revenue are expected to rise in all the other segments. We also expect an increase in income, mainly in the Wellness and Real-Estate Agents business segments, which have remained strong, and the Residential segment, in which the profitability of sales of condominium units is expected to improve, in addition to the Innovation Business, where improvement is expected.

Compared with the initial forecast, we have revised operating revenue downward by ¥10 billion, mainly because some of the sales of properties in overseas operations, which were expected in the Innovation Business, will be held up, which will offset the expected increase in gain on sale of buildings for investors, etc. in the Urban Development segment.

We anticipate that interest-bearing debt will be ¥1,140 billion and the D/E ratio will be kept at 2.6, as initially planned.

We also plan to pay the initially planned annual dividend, which is ¥13 per share (interim dividend of ¥6.5 and year-end dividend of ¥6.5).

|

|

|