|

|

|

|

|

|

|

|

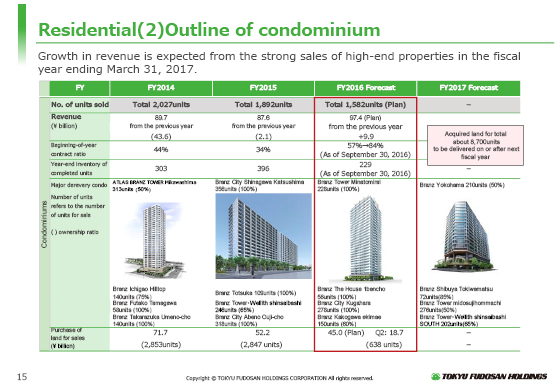

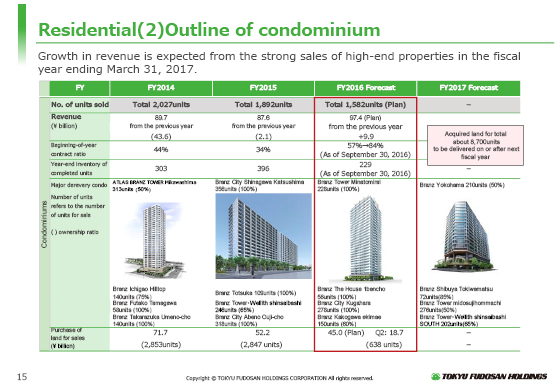

Next, I will outline our plan for the sale of condominium units.

We plan to sell 1,582 units and record revenues of ¥97.4 billion for the fiscal year ending March 2017.

As shown in the middle of the table, the contract ratio to sales forecast for condominiums increased steadily to 84%, and the inventory of completed units decreased from the end of March, to 229 at the end of September 2016.

The gross margin on condominium units for the fiscal year ending March 31, 2017 (which is not shown in the presentation material) is expected to be approximately 26%.

The gross margin for the first six months was approximately 23%.

As shown in the “Purchase of land for sales” column at the bottom of the table, we acquired land for 638 units for ¥18.7 billion in the first six months. We select our investment destinations carefully.

As a result, we have acquired land for a total of 8,700 units already scheduled to be recorded during the fiscal year ending March 2018 or thereafter, as indicated in the upper right section of the table.

We expect that sales of condominium units will generally remain strong, despite the absence of extremely strong properties such as BRANZ TOWER Minato Mirai and BRANZ The House Ichibancho.

|

|

|