|

|

|

|

|

|

|

|

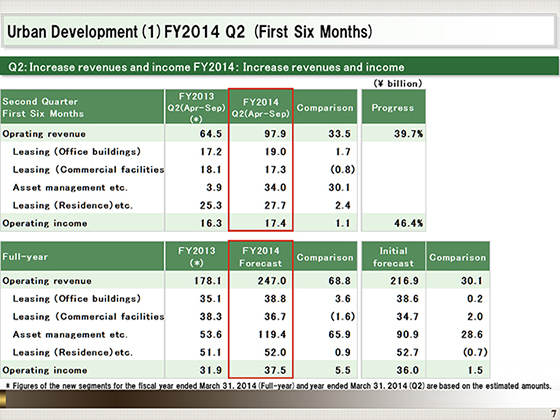

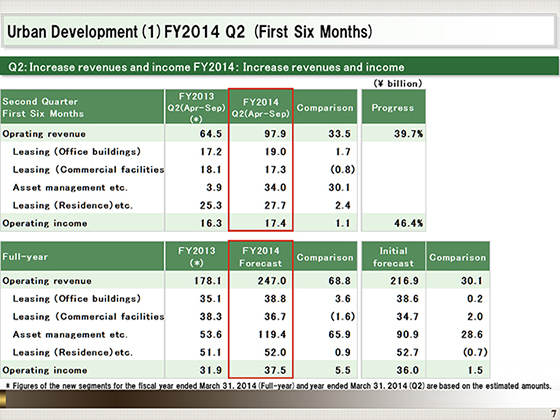

I will now provide an overview of the results and forecast by segment. First, I will explain the results in the Urban Development segment.

In the first six months of the fiscal year ending March 2015, operating revenue increased ¥33.5 billion year on year, to ¥97.9 billion, and operating income was up ¥1.1 billion, to ¥17.4 billion.

Concerning the ¥33.5 billion increase in operating revenue year on year, a major negative factor was the ¥3.6 billion decline due to the loss of revenue following the sale of property, such as the Times Square Building which was sold in the previous fiscal year. This was offset by positive factors such as a ¥29.6 billion increase due to the sale of part of Ebisu Prime Square, etc. and a ¥5.2 billion increase due to new operations as a result of acquiring part of Shiodome Building, etc. With these factors, operating revenue recorded a ¥33.5 billion increase year on year.

The major factors for the ¥1.1 billion increase in operating income year on year included a ¥1.5 billion decline associated with lost sales, as in operating revenue, among others, which was offset by a ¥2.4 billion increase due to new operations. With these factors, operating income increased ¥1.1 billion year on year.

As for the forecast for the fiscal year ending March 2015 at the bottom, we anticipate operating revenue of ¥247.0 billion, increasing ¥68.8 billion from the previous fiscal year, and operating income of ¥37.5 billion, rising ¥5.5 billion.

We have revised up the forecast for operating revenue by ¥30.1 billion from the initial forecast, anticipating an increase in the sale of buildings for investors, etc.

With respect to the factors for the ¥5.5 billion increase in operating income, we anticipate a ¥3.0 billion loss mainly due to the loss of revenue from the Times Square Building, while we expect a ¥5.1 billion increase due to new operations and a ¥3.0 billion increase in gains on sales of properties. With these factors, we expect operating income to increase ¥5.5 billion.

|

|

|