|

|

|

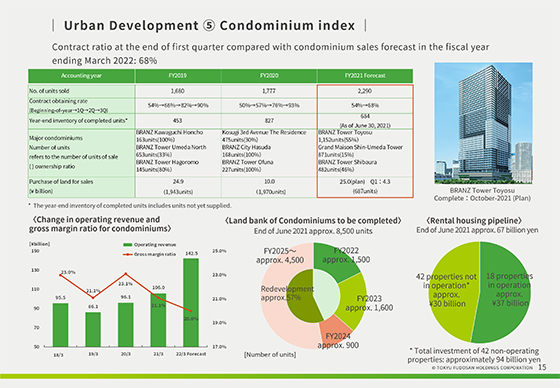

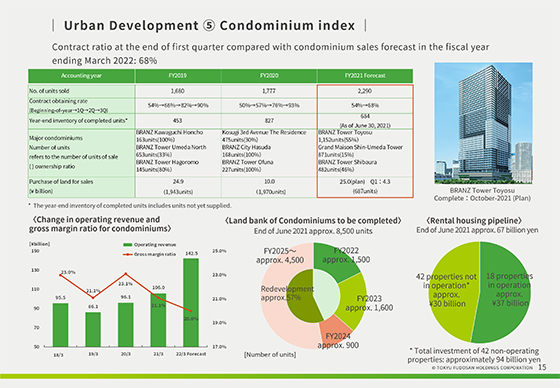

This is a trend of operating indicators for condominiums for sale.

For FY2021 ending March 31, 2022, we will plan to record 2,290 units and sales of JPY142.5 billion.

The condominium market continues to be strong, and the contract obtaining ratio for the full year was 68% at the end of June.

Completed inventory was 827 units at the beginning of the fiscal year, but it decreased to 684 units as of the end of June, and sales have progressing steadily.

Although the gross margin ratio of condominiums for the first quarter, when the ratio of newly recorded properties is small,was 17%, the same ratio is planned to be 20.0% for FY2021 ending March 2022.

Land investment of JPY4.3 billion, equivalent to 687 units, has been acquired, bringing the total land bank to approximately 8,500 units scheduled to be booked in the next fiscal year and beyond.

The percentage of redeveloped properties in the Land Bank is 57%, and we will continue to focus on redeveloped properties with high added value.

|

|

|