|

|

|

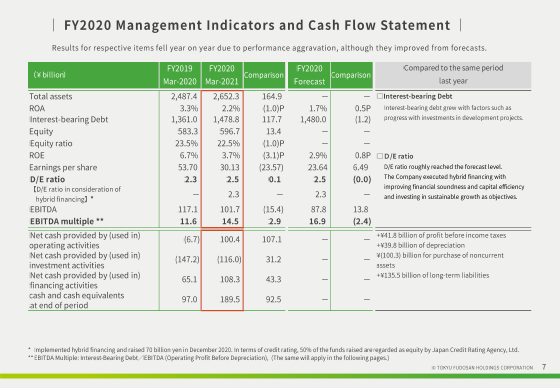

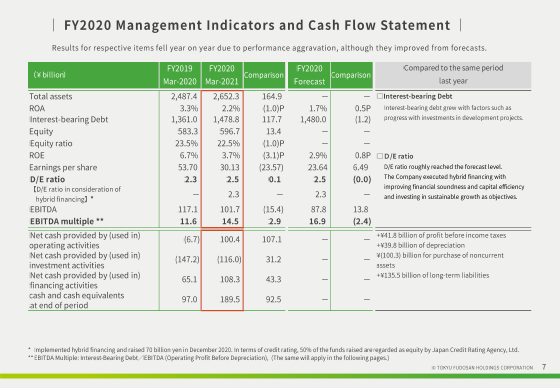

Explanation of key management indicators and cash flows.

Due to the deterioration of business performance caused by COVID-19, each indicator deteriorated compared to the previous fiscal year.

Although the D/E ratio was 2.5 times, the D/E ratio in the rating was 2.3 times due to the partial capitalization certification through hybrid financing.

We will continue to raise funds while being conscious of our financial soundness.

Next is cash flow.

Net cash used in investing activities decreased by JPY116 billion, mainly due to the acquisition of fixed assets, but this was offset by cash flows from operating activities and cash flows from financing activities, including hybrid financing. The balance of cash and cash equivalents at the end of the fiscal year was JPY189.5 billion, up JPY92.5 billion from the previous fiscal year.

|

|

|