|

|

|

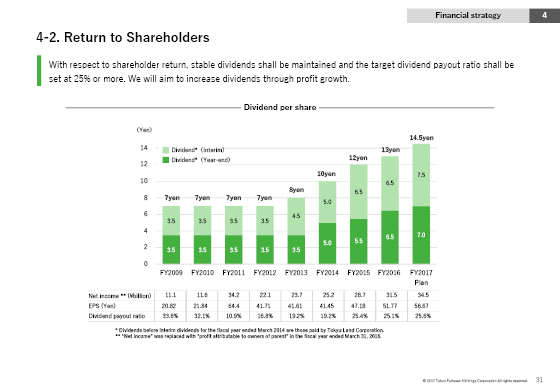

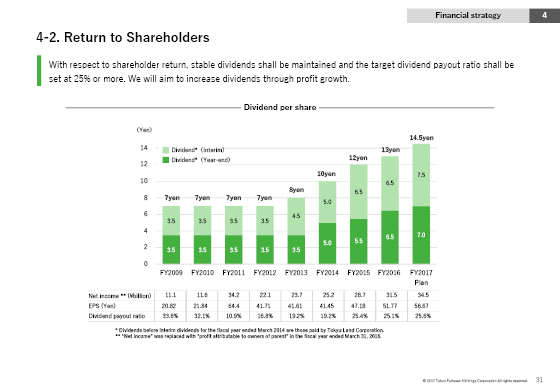

Finally, I would like to explain our measures regarding shareholder returns.

The dividend policies maintained stable dividends, targeting a dividend payout ratio of 25% or more.

In FY2017, we are planning a dividend of ¥14.5, which will mean consecutive dividend increases for five years along with profit growth.

We will continue responding to the expectations of all our shareholders by increasing the dividends in accordance with profit growth in the future.

As we announced on May 11, it has been resolved to introduce a new fiduciary stock compensation plan for the directors of the Group.

It is intended to clarify the linkage between stock values and remunerations for directors and raise the awareness for contribution to the increase in corporate value by improving the medium- and long-term business results.

This is the end of the Medium-Term Management Plan.

Please see the reference information on the detailed planned values of operating profit by segment for FY2020.

|

|

|