|

|

|

|

|

|

|

|

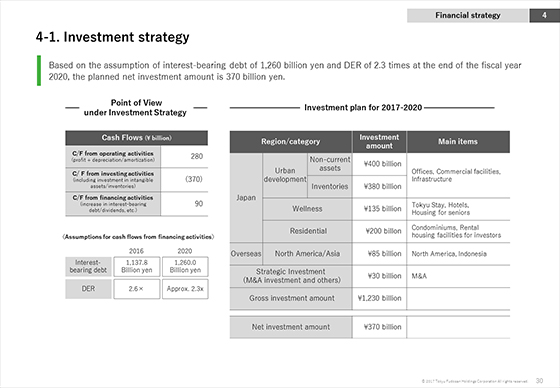

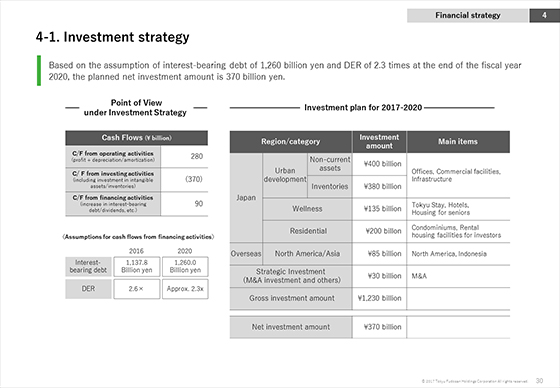

I would now like to explain our financial strategy.

First, about our investment plans.

The premise of the investment strategy for the period of this Medium-Term Management Plan is the plan to spend ¥370.0 billion, which is the total of the estimated cash flows from operating activities for these four years of ¥280.0 billion and the estimated cash flows from financing activities of ¥90.0 billion gained mainly due to increased interest-bearing debt, etc., for the investment for non-current assets and inventory assets.

It is expected that the gross investment amount for the investment plan will come to ¥1,230.0 billion.

The breakdown is as follows.

In the Urban Development segment, a total investment of ¥780.0 billion is planned in non-current assets and inventory assets in view of new investments in the new fields of offices, commercial facilities and infrastructure in addition to the investment in the existing major projects including redevelopments in Shibuya.

In addition, in the Wellness segment that is expected to grow into a new core business, investment of ¥135.0 billion is planned including the expected investments for Tokyu Stay, public hotels and senior citizen housing.

In addition to the above, investments in the Residential and Urban Development segments centered on the United States and Indonesia are expected, and the gross investment amount is to be ¥1,230.0 billion. Considering cyclical reinvestments, however, the net investment amount will be around ¥370.0 billion.

|

|

|