|

|

|

|

|

|

|

|

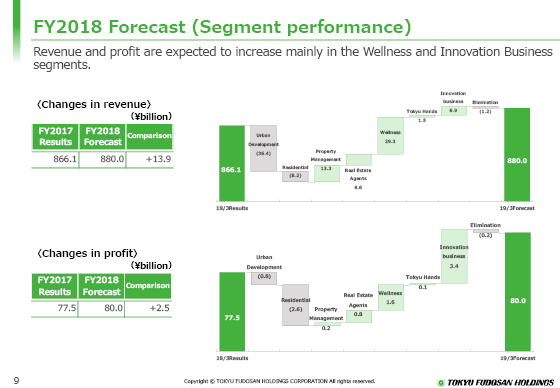

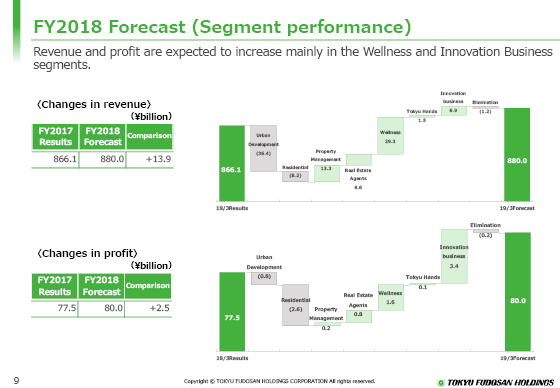

The operating revenue of the Urban Development segment, as shown in the bar chart in the upper part, will decrease mainly due to a decrease in revenue from sales of properties, including buildings for investors. However, based on the expected sales increase mainly due to the delivery of the membership resort hotel Tokyu Harvest Club Karuizawa & VIALA, which will open in July 2018 in the Wellness segment, and the planned delivery of condominiums in Indonesia in overseas operations of the Innovation Business segment, among other factors, the overall revenue is expected to increase ¥13.9 billion year on year.

Operating profit of the Residential segment shown in the lower part will decrease due to a decrease in the number of unit sales of condominiums. However, as in the case of operating revenue, such profit decrease is expected to be covered by the profit increase in the Wellness segment and the Innovation Business segment, among others. The overall profit is expected to increase ¥2.5 billion year on year.

|

|

|